Owning a car is a popular milestone in life, especially for those who are able to purchase their first vehicle themselves. What many first-time car buyers don’t realize is that they should check their credit score prior to visiting dealerships for test drives. The worst thing that can happen is getting through the test drive, picking out a model, and beginning the paperwork only to find out that their credit score is not good enough to make the purchase.

It’s Not Impossible

One thing you must remember when buying a car is that it’s not impossible to purchase a vehicle with a poor credit score. The catch is that you won’t be able to buy a good car and it will be a difficult process to get approved. You might need a cosigner with better credit to help you purchase the car. This is why you should always check your score prior to shopping.

Average Score Needed

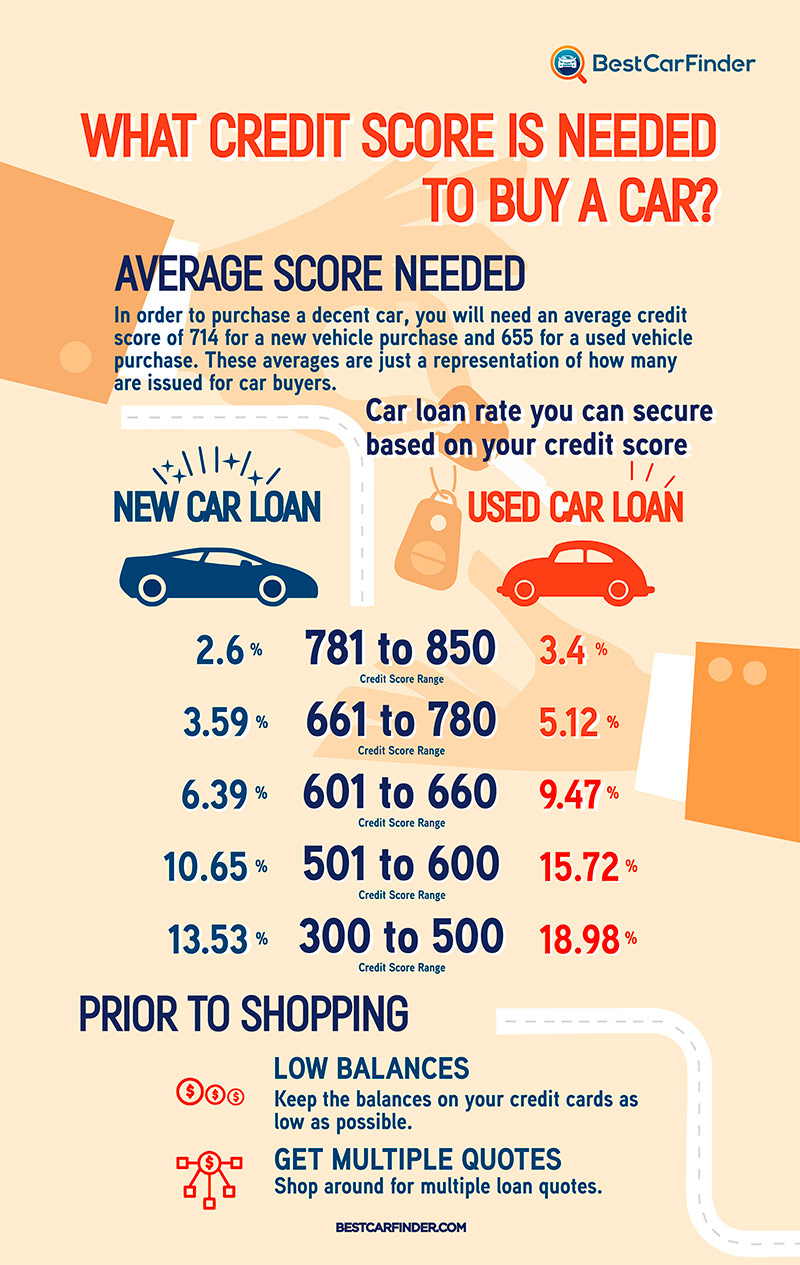

In order to purchase a decent car, you will need an average credit score of 714 for a new vehicle purchase and 655 for a used vehicle purchase. These averages are just a representation of how many loans are issued for car buyers. Loans are still issued for buyers with credit much lower than 600, which is known as deep subprime credit.

Credit Scores and Car Loan Rates

If you are wondering what type of car loan rate you can secure based on your credit score, you’ve come to the right place. Below are the credit score ranges for new and used and the loan rates that typically come with each.

Credit Score Range | New Car Loan | Used Car Loan |

781 to 850 | 2.6 % | 3.4 % |

661 to 780 | 3.59 % | 5.12 % |

601 to 660 | 6.39 % | 9.47 % |

501 to 600 | 10.65 % | 15.72 % |

300 to 500 | 13.53 % | 18.98 % |

Prior to Shopping

If you are in the market for a new car, or at least new to you, there are some things you might want to take care of prior to visiting the dealership aside from just researching your credit score. In fact, researching your credit score will help you realize that these few items should be on your to-do list if you want to secure a favorable loan for your vehicle purchase.

In order to improve your credit score in an effort to secure the best loan rate possible, you should keep the balances on your credit cards as low as possible, pay all of your bills by the due dates, and open new lines of credit only when absolutely necessary.

It’s also a smart move to check your credit report on a consistent basis for any inaccuracies. Inaccuracies will have a negative effect on your credit score and should be rectified as soon as possible, especially if you are preparing to buy a new car.

Multiple Quotes

When you begin shopping for a new car you should shop around for multiple loan quotes. You don’t want to rely on just the lender the dealership uses for the loan. The more quotes you acquire, the better loan rate you can secure for your vehicle purchase.

As you can see, having a higher credit score is better for your vehicle purchase, especially if you will be buying the car using financing.